Snaxshot #07: Convenient Cocktails

they pack a punch!

A newsletter on upcoming food and beverage trends that offers a curation of brands and aesthetics written by Andrea Hernández.

You can support Snaxshot monthly now!

🔮 Peek into the future:

What’s boosting these spirits?

Snaxshot of market + who’s making moves.

Favorite brands in the space.

Market challenges + opportunities.

Don’t be shy, the water’s warm, don’t forget to hit the subscribe button below.

Boosting Spirits

Pre-pandemic most millennials would arrive home from their Instagrammable venues after spending a night at an actual bar with friends in boozy bliss, probably staring at a semi-empty bar cart because who makes cocktails anyways? Then Covid came along and with it began an endless drinking game, that so far, is being won by RTD spirits.

Leave it to the generation of instant gratification to revive a category that saw its decline before most of them were even born. RTDs are perfect for millennials who are very keen to cleaning up not only their pantries, but their bar carts as well, looking for lower-calorie drinks that are readily accessible, without additional fuss, and that offer the same Instagrammable vibe as a craft cocktail.

Resurgence of RTD 🍷

—Market size of US RTD spirit product in 2020 is of $4.9 billion.

—In 2020, alcohol sales online experienced triple digit growth! These numbers are the fastest-growing sector Nielsen measures in the alcohol space.

—For alcohol delivery startup Drizly, new customers have doubled in 2020 and currently make up 33% of the company's total sales! The RTD segment has grown 416% in share of sales year-over-year.

—In the US alone, the RTD sector is expected to report volume growth of 21.8% CAGR from 2019-2024, stealing market share mainly from beer. (Beer sales have experienced steady decline for the past 5 years.)

—Data from IWSR shows that RTD sales volume increased 43.2 % in 2019, nearly tripling 2018’s 16.9 % growth.

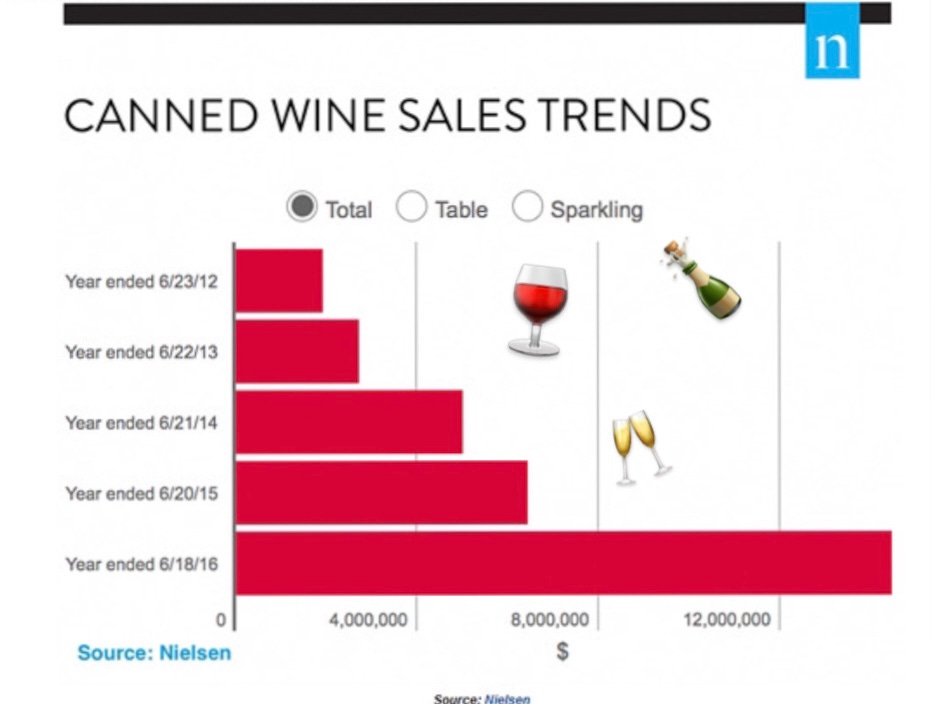

—For the first time in 25 years sales of wine bottles declined, losing share to canned wine. In less than a decade, sales of wine in cans have jumped from just $2 million in 2012 to $183.6 million.

—Over the past 5 years, volume consumption of tequila in the US grew by more than 40%. In 2020, tequila saw biggest spike, up more than 75%, now fastest growing spirits segment in the U.S

—From summer 2019 to summer 2020, hard seltzer category saw $2.7 billion in sales as consumers decreased spending on beer and wine.

—According to Nielsen at the beginning of 2018, just 10 hard seltzer brands were on the market, rising to 26 a year later and now more than 65 brands exist, half using a unique brand name, and the other half pivoting off an existing beer brand name.

—Global sales of canned cocktails are predicted to surpass $146 billion over the next 10 years .

—According to Euromonitor, sales of RTD cocktails in the U.K., are about 2.6 times greater than in the U.S.